U.S. IRS Certificate (IRS Certificates) – Hague Apostille and Consular Authentication

What is a U.S. IRS Certificate (IRS Certificates)?

A U.S. Internal Revenue Service (IRS) certificate is an official document that verifies the tax registration status of an individual or business in the United States. These certificates are commonly used to confirm an entity’s tax identity, such as when applying for an Employer Identification Number (EIN) or proving tax compliance in the U.S.

IRS certificates are particularly important for multinational companies or individuals engaged in international financial transactions, as they can serve as proof of tax status to foreign governments or businesses.

U.S. IRS Certificate (IRS Certificates) – Case Example

You know, this can be quite complicated, but I’ll do my best to explain it clearly.

First of all, what exactly is a “U.S. IRS Certificate” (IRS Certificates)? Simply put, IRS stands for the Internal Revenue Service, which is responsible for tax administration and issuing related official documents in the United States.

Typically, these certificates are issued by qualified departments or institutions in specific states and cities within the U.S. After issuance, they must go through the necessary authentication procedures to be officially recognized in other countries.

For instance, some clients may need a specific tax certification document issued by the U.S. IRS for various business matters in China, such as company registration, foreign exchange settlements, tax incentive applications, or financial compliance reviews.

To put it simply, if you want to conduct legitimate cross-border business in China—say, setting up a foreign-invested company in Shanghai or submitting tax documents for a U.S.-affiliated enterprise in Shenzhen—you may need a U.S. IRS certificate to verify your company’s tax identity and related records in the U.S.

However, this certificate cannot be used directly in China because each country has its own notarization and authentication system.

In the past, if you had a U.S. document that needed to be used in China, you had to go through a lengthy and costly consular authentication process. It involved multiple layers of verification, with each step requiring official stamps—an exhausting and time-consuming procedure.

But things have changed! On March 8, 2023, China officially joined the Convention Abolishing the Requirement of Legalization for Foreign Public Documents (commonly known as the Hague Apostille Convention). This convention took effect in China on November 7, 2023, meaning that U.S. documents that have been Hague Apostilled (Apostille) can now be used in China with a much simpler process.

It’s like giving foreign documents a “global pass”—as long as they have been Apostilled, they can be used in China without the previously cumbersome authentication procedures.

Why Do Clients Choose the Washington, D.C. Notary Office for Hague Apostille of U.S. IRS Certificates?The reason is actually quite simple. Washington, D.C. is the political and diplomatic center of the United States, and the Washington, D.C. Notary Office has extensive experience and a deep understanding of relevant policies.

Their process involves first verifying the authenticity and validity of the IRS certificate, then notarizing the document, and finally assisting with the Hague Apostille procedure at the Secretary of State’s Office. This ensures that the document gains legal validity for use in Hague Convention member countries.

With this Apostilled IRS certificate, clients no longer have to worry about its legal effect in China. There’s no need to go through the complex consular authentication process. Instead, they can directly use the document for official purposes in China—whether for business registration in Shanghai or submitting tax-related documents to a bank in Shenzhen, it will be readily recognized.

In SummaryThis process helps clients save time, effort, and hassle. What used to take several months of back-and-forth authentication can now be completed much more quickly.

With China joining the Hague Apostille system, cross-border business operations and approval processes have become more efficient and streamlined. For businesses and individuals engaged in U.S.-China transactions, this is undoubtedly great news.

We share case examples to help everyone better understand the relevant processes and application scenarios.

Please note: The company names and individual names mentioned in this explanation are purely fictional. Any resemblance to real companies or individuals is purely coincidental.

Our case studies are for reference only and are intended to provide a framework for thinking and decision-making. When applying this information, please carefully consider your own specific situation and seek professional advice or further verification if necessary.

What is U.S. Hague Apostille (Apostille)?

Hague Apostille, also known as Apostille, is an international certification that verifies the legality of a document in one country so that it can be recognized in another country that is a signatory to the Hague Convention.

In the United States, Apostilles are typically issued by the Secretary of State’s office in each state. This certification is commonly used for legal documents such as birth certificates, marriage certificates, and corporate documents—including IRS certificates.

With a Hague Apostille, these documents can be used in other countries without needing additional authentication.

What is U.S. Consular Authentication (Authentication)?

Consular Authentication, also known as Authentication, is a document certification process that verifies the legality of a document in the United States, allowing it to be used in countries that are not members of the Hague Convention.

This process typically involves multiple steps, including state-level and federal-level official seals and signatures. Consular authentication ensures that documents are accepted and recognized in the destination country. It is commonly required for purposes such as working or studying abroad, as well as for official dealings with foreign governments.

Washington, D.C. Notary Office – Document Processing Services

The Washington, D.C. Notary Office provides document processing services for individuals and businesses in need of Hague Apostille or Consular Authentication. Whether you require authentication for an IRS certificate or other official documents, the Washington, D.C. Notary Office offers fast and reliable services.

Their services include document review, official submission requests, and communication with relevant government agencies, ensuring a smooth and efficient authentication process.

This service is especially valuable for clients who are pressed for time or unfamiliar with the procedures, helping them save time and reduce risks associated with improper document handling.

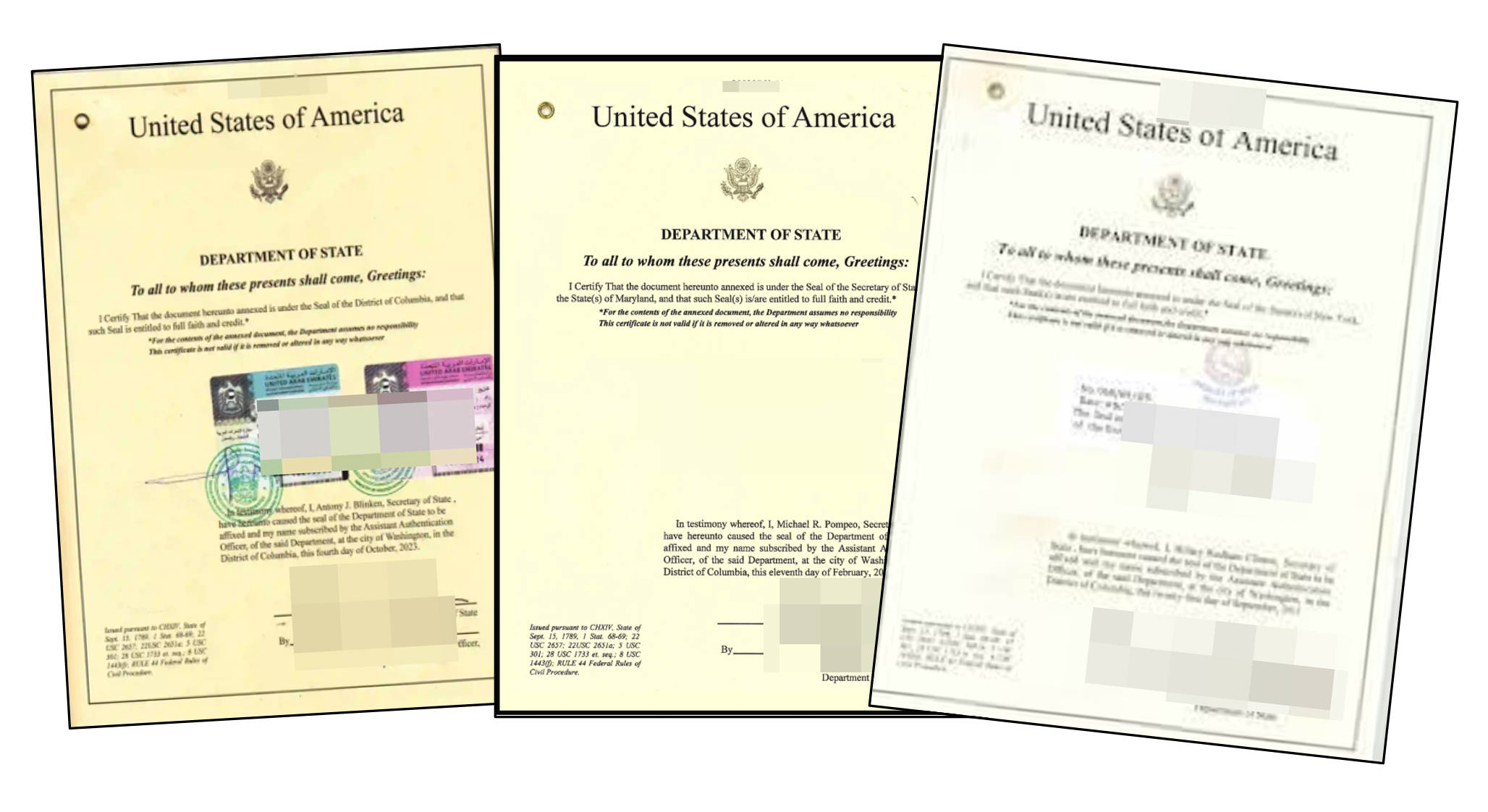

Apostille Sample

Authentication Sample